Mr. Firmin OUEDRAOGO

Until now, Burkina Faso has relied largely on external financial resources and contributes very little to the financing of the management and protection of its water resources. Resource mobilization depends on the formulation and submission of projects by stakeholders for funding to donors. "However, many of the problems related to water resources are urgent and management must be permanent without external conditionality," adds the SP/IWRM expert. It is good that the State can reaffirm more the sovereignty it claims over the water sector.

Also, Mr. OUEDRAOGO explained the foundations of the organic law on water management, notably in its article 47 which stipulates that "the use of water requires that each person participate in the effort of the Nation to ensure its management...", article 49 which states that "natural or legal persons who use water for purposes other than domestic may be subject to the payment of a financial contribution based on the volume of water consumed or mobilized; this contribution must be used as a priority for financing the water sector ". He explained the entire process that led to the law, starting with the study on the implementation of the CFE in 2004. These steps include:

Also, Mr. OUEDRAOGO explained the foundations of the organic law on water management, notably in its article 47 which stipulates that "the use of water requires that each person participate in the effort of the Nation to ensure its management...", article 49 which states that "natural or legal persons who use water for purposes other than domestic may be subject to the payment of a financial contribution based on the volume of water consumed or mobilized; this contribution must be used as a priority for financing the water sector ". He explained the entire process that led to the law, starting with the study on the implementation of the CFE in 2004. These steps include:

- The definition of the legal nature adapted to the objective of the CFE (parafiscal option, definition of the basis of the contribution: levy, modification, pollution; identification of the taxable persons and proposal of rates for the levy).

- Drafting of legal texts (drafting and adoption of law 58 -2009, drafting and adoption of a decree in 2011 and joint order).

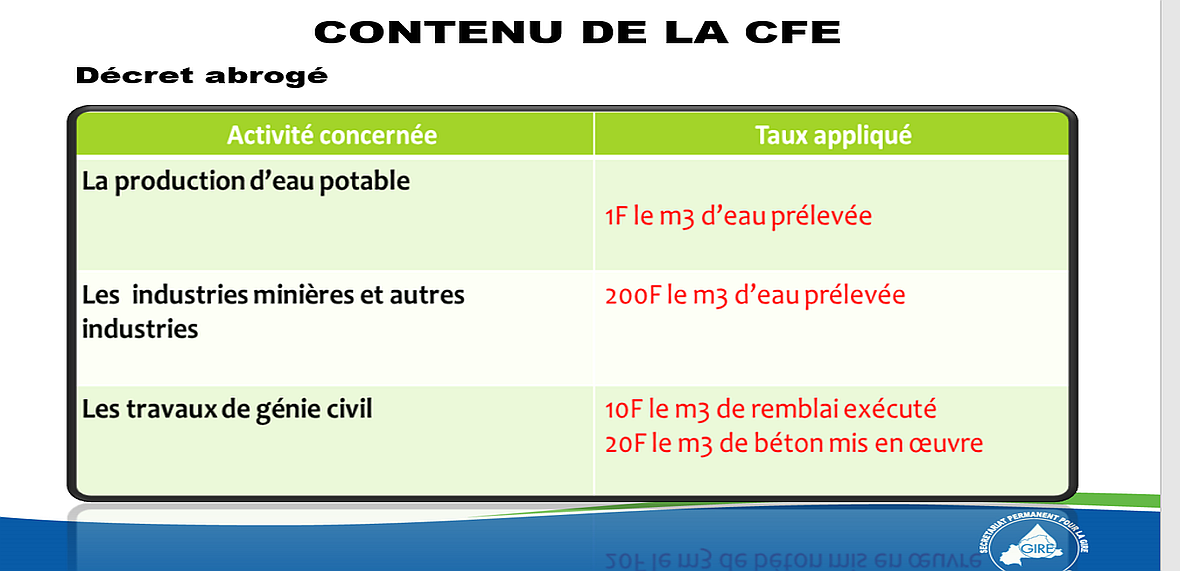

"To date, only the levy tax is in force according to the rates adopted in 2015. Other taxes are under study or development," explained Mr. OUEDRAOGO, who said that it is on the suggestion of some taxpayers that the rates of 2011 have been revised to give way to those of 2015. A joint decree determines the destinations and terms of use of the CFE collected. He supported his remarks with the various legal elements that were developed and made available to visitors. The CFE applies to any natural or legal person because of the withdrawal of raw water, the modification of the watercourse regime or pollution. However, raw water withdrawals for domestic use are exempted from the withdrawal tax (article 7 of law 02/2001); because the article of the same law gives everyone the right to have water corresponding to their needs and the basic requirements of their life and dignity.

"To date, only the levy tax is in force according to the rates adopted in 2015. Other taxes are under study or development," explained Mr. OUEDRAOGO, who said that it is on the suggestion of some taxpayers that the rates of 2011 have been revised to give way to those of 2015. A joint decree determines the destinations and terms of use of the CFE collected. He supported his remarks with the various legal elements that were developed and made available to visitors. The CFE applies to any natural or legal person because of the withdrawal of raw water, the modification of the watercourse regime or pollution. However, raw water withdrawals for domestic use are exempted from the withdrawal tax (article 7 of law 02/2001); because the article of the same law gives everyone the right to have water corresponding to their needs and the basic requirements of their life and dignity.

Mr. OUEDRAOGO explained the modalities for collecting the CFE. This explanation was followed by lively exchanges which enabled Mr. OUEDRAOGO to conclude that "it is advisable for the Ministry of Water and Sanitation to play its part by completing all the texts provided for by the law and to optimise the means of collection as well as the uses of the resources collected".